The truth is (IIP) income insurance protection isn’t “Top of Mind” or likely to be found on anyone’s daily “To Do List”, and who expects to suffer a disabling injury or illness that prevents them from working and earning an income, but everyone should have a plan in place if they do. (IIP) income insurance protection provides a solution to this daunting and serious possibility.

Personally speaking, I hope you never receive a penny from an income insurance protection policy and therefore never experience a front row seat to the financial devastation a disability can cause!

Why income protections matters? It’s the greatest risk and need because it helps you protect the asset you rely on most – your income during your working and earning years. Many simply do not realize a long-term disability without adequate income creates an ECONOMIC NIGHTMARE.

“People tend to think about disability in terms of catastrophic events, like a terrible car accident that leaves you paralyzed or in a nursing home. Less dramatic and much more common conditions such as arthritis, back pain, heart disease, cancer, depression, diabetes, and even pregnancy are some of the leading causes of disability in the U.S.”

– Richard Frank, Ph.D., Deputy Assistant Secretary for Disability, Aging and Long-term Care Policy at the U.S. Department of Health and Human Services in Washington, D.C.; WebMD Feature, R. Morgan Griffin.

HERE ARE 12 BIG MYTHS, MISCONCEPTIONS, AND TRUTHS

ABOUT DISABILITIES / INCOME PROTECTION

Big Myth & Misconception #1:

“Disability? It won’t happen to me.”

I would hope your right! Unfortunately, the vast majority of income earners grossly underestimate the risk and their chances of becoming disabled. The odds as you can see are much higher!

Although disability income planning is often overlooked, the underlying risk has a substantially greater likelihood of occurring and is far more financially devastating because so very few people plan for it. THIS IS WHY GOOD INCOME INSURANCE PROTECTION IS NOT A LUXURY ITEM BUT AN ABSOLUTE NECESSITY!

Remember 1 in 4? Where will the money come from if you’re the ONE! Owning a good (IIP) policy can save your financial life if you’re the ONE facing a disability.

You can’t control the odds against a disability occurring. However, you can control the consequence should life throw you a curveball. Consider the following:

A MALE — age 35, 5’ 10”, 170 lbs., nonsmoker, who works an office job and leads a very healthy lifestyle with the MOST FAVORABLE RISK FACTORS has…

An 11% chance of becoming disabled for 3 months or longer during his working career with a 38% chance that the disability would last 5 years or longer. (Council for Disability Awareness, Personal Disability Quotient Calculator)

A FEMALE — age 35, 5’ 4”, 125 lbs., non-smoker, who works an office job and leads a healthy lifestyle with the MOST FAVORABLE RISK FACTORS has…

A 16% chance of becoming disabled for 3 months or longer during her working career with a 38% chance that the disability would last 5 years or longer. (Council for Disability Awareness, Personal Disability Quotient Calculator)

WHAT’S YOUR PDQ?

FIND OUT NOW! Calculate your own Personal Disability Quotient (PDQ) at www.whatsmypdq.org and learn what’s really at stake.

Everyone should know and understand their chances of not being able to earn an income. That’s what your Personal Disability Quotient (PDQ) calculates — your own chance of being injured or becoming ill that could force you to miss work for an extended period of time.

Why is this number so important? Think about it. Your ability to earn an income is your most valuable resource. It’s what enables you to fund almost everything else that’s important to you…your home, your family’s lifestyle, your children’s education, your retirement.

Big Myth & Misconception #2:

“I don’t work in a dangerous occupation, so I don’t need disability insurance.”

Some occupations are more hazardous than others. However, 90% of most disabilities are illness related and don’t discriminate based upon occupations or professions.

According to (CDA) Council for Disability Awareness 2013 long-term disability claims review, the following were the leading causes of new disability claims in 2012:

Cancer (14.6%)

Injuries and poisoning (10.6%)

Mental disorders (8.95%)

Cardiovascular / circulatory disorders (8.2%)

Musculoskeletal / connective tissues disorders (28.5%). This category includes claims caused by neck and back pain; joint, muscle and tendon disorders; foot, ankle and hand disorders, etc.

Big Myth & Misconception #3:

“I’m too young. Disability happens to older people.”

Being young doesn’t mean you’re less at risk because a disabling illness or injury doesn’t discriminate because of youth. The earlier you plan with (IIP) income insurance protection, the easier it is to qualify and your premiums are less.

THINK (IIP). It’s the smart thing to do!

Big Myth & Misconception #4:

“I’m single.”

Do you have financial obligations and bills that come due every month? No one is exempt because we’re human. Tragic events happen to good people as well as single people. Ignoring the risk doesn’t make the risk go away. It takes foresight to believe something can happen to you in a split second and change the course of your life.

Just because you’re single doesn’t mean you don’t need to be financially prepared should a disability strike. Protect yourself, your income and your future. Think (IIP) income insurance protection!

Big Myth & Misconception #5:

“Life insurance is far more important than disability coverage.”

Many people are aware of the importance of purchasing life insurance when married and or with children. They’re less likely to recognize how important it is to purchase disability insurance. This can be a serious financial mistake.

At no age prior to age 65 is the risk of death greater than the risk of becoming disabled. The financial implication of a disability can be even more disastrous than that of premature death. Why? Economic death occurs when a disability strikes. If you can’t work, where will the money come from to pay your bills?

Death is certain to occur at some point, while a disability may never occur, the risk is still much higher. Remember, most deaths occur after your income earning years. During one’s income-earning years, when the financial impact is more strongly felt, disability is a greater threat and more likely to occur. This is why (IIP) income insurance protection is so important and must be purchased before it is needed.

For more information, see “Death vs Disability – The Inconvenient Truth!”

Big Myth & Misconception #6:

“I only have to worry about my daily living expenses if I become disabled.”

Being able to continue to pay your daily expenses during a disability is paramount. But, losing your income can impact you in many other ways too. Disability causes nearly 48% of mortgage foreclosures (Source: Housing & Home Finance Agency on the U.S. Government). The American Journal of Medicine also reports that every 90 seconds, someone files for bankruptcy in the wake of a serious illness. In fact, more than 50% of all personal bankruptcies have underlying, unpaid medical expenses. The “costs” of being disabled today are much more than meets the eye.

THE MYTH THAT EXPENSES GO DOWN DURING A DISABILITY IS JUST THAT — A MYTH!

Big Myth & Misconception #7:

“If I do become disabled, it won’t last long.”

This myth is not surprising since 85% of workers express little or no concern that they may suffer a disability over three months. While it’s true many disabilities only last a few months, the average disability actually lasts 2.6 years (Source: General Re, U.S. Individual DI Risk Management Survey 2011, based on claims closed in 2010). In fact, 1 in 8 workers will become disabled for 5 years or more during their working careers. (Source: Commissioners Disability Insurance Tables A and C, assuming equal weights by gender and occupation, and statistics at www.ssa.gov.)

Big Myth & Misconception #8:

“I’m covered at work, I have group LTD.”

NO to LOW premiums and the fewer underwriting (medical) questions asked to get accepted WILL NEVER PROVIDE THE BEST DISABILITY COVERAGE FOR YOU, and YOU’LL ALWAYS GET WHAT YOU PAY FOR when comparing group LTD to an individually underwritten (IIP) income insurance protection policy.

Free, cheap or inexpensive group disability coverage has too many deficiencies and restrictions that simply benefit the insurance company rather than you. Remember “less expensive” can be “more expensive” especially when you need the money the most at claim time. (IIP) is simply in your best long-term interest.

Big Myth & Misconception #9:

“I have enough savings and investments.”

That is great if you do! Why not protect them with (IIP) income insurance protection rather than liquidate them? Don’t you think it would be easier to budget a premium for (IIP) rather than paying unknown and ongoing monthly expenses should a disability occur?

However, according to the American Payroll Association’s “Getting Paid in America” Survey in 2012, 68% of Americans would find it very difficult or somewhat difficult to meet their current financial obligations if their next paycheck were delayed for one week.

In addition, the Council for Disability Awareness, Disability Divide Consumer Disability Awareness Study, 2010 reported 38% of working Americans could not pay their bills for more than 3 months.

Only one-third of today’s workers have disability insurance through work, leaving an estimated 75 million Americans without coverage. Yet the Federal Reserve reports that three-quarters of workers today do not have enough emergency savings to cover six months or more of their expenses and half of all households could not raise $400 for an immediate financial emergency.

Big Myth & Misconception #10:

“I will apply for Social Security disability insurance benefits that should be enough.”

Better to understand this Big Myth Now!

Consider the application process for (SSDI) is difficult and can take months or even years to qualify for disabilities expected to last a year or more.

Rejections are common. Consider 65% of initial SSDI claim applications were denied in 2012. (Social Security Administration, Disabled Worker Beneficiary Statistics, Dec. 2012)

Social Security Disability Insurance (SSDI) benefits average $1,171 a month which is just above the 2017 federal poverty line for an individual. (Social Security Administration, Basic Facts, June 2016 and Department of Health and Human Services, 2017 Federal Poverty Guidelines, January 2017).

Consider almost nine million American disabled workers currently receive SSDI benefits. Most have no other source of income. (Social Security Administration, Basic Facts, June 2016)

Who could pay for modest personal living expenses on an amount this small?

A safer smarter way is to protect yourself with (IIP) income insurance protection!

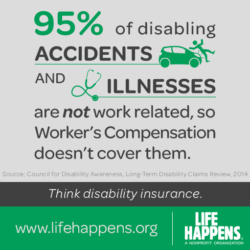

Big Myth & Misconception #11:

“There’s always workers’ compensation that should cover me.”

Many people believe if they do become disabled, it will likely result from an accident occurring at work and, by extension, believe that “workers’ comp” will provide income replacement. But in fact, the Council for Disability Awareness reports 90 percent of all disabilities are from illness, and although it’s true that workers’ comp replaces a portion of income in the event of a work-related injury or illness, the council’s statistics show there’s less than a 5 percent chance that disabling injuries and illness are work-related. Workers’ compensation simply does not cover the vast majority of disabilities.

Big Myth & Misconception #12:

“It’s too expensive.”

(IIP) income insurance protection is budget friendly when you compare it to your daily cup of caffeine, work lunches, or cell phone bill. It’s more affordable than you think.

No one needs to insure against every risk. However, some risks are much more important and have a much higher frequency with devastating financial consequences for the unprotected.

Income pays for everything! Income is your most important asset! Income is the greatest risk you face during your income earning years. (IIP) income insurance protection is an ideal and affordable way of shifting this risk and financial impact of a disability to the insurance company.

“IT’S TIME TO DO DISABILITY INCOME FINANCIAL PLANNING!”

According to the Council for Disability Awareness, Worker Disability Planning and Preparedness Study, 2009:

Nearly nine in ten workers (86%) surveyed believe that people should plan in their 20’s or 30’s in case an income-limiting disability should occur.

Only half (50%) of all workers have actually planned for this possibility.

Fewer than half (46%) have even discussed disability income planning.