Which is the greater risk you face, becoming disabled or dying before the age of 65?

Are your insurance priorities reversed if you purchase life insurance and not disability insurance?

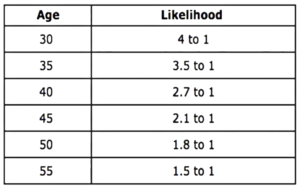

This chart shows the likelihood of a disability occurring over death before age 65.

AT NO AGE IS THE RISK OF DEATH GREATER THAN THE RISK OF BECOMING DISABLED.

A disability’s financial implications can be even more disastrous than that of premature death.

Why? Economic death occurs when a disability strikes.

If you can’t work, where will the money come from to pay your bills?

This is why an individual disability insurance policy is so important and must be purchased before it is needed.

Death is certain to occur at some point, while a disability may never occur, the risk is still much higher.

Remember, most deaths occur after your income earning years. During one’s income-earning years,

when the financial impact is more strongly felt, disability is a greater threat and more likely to occur.

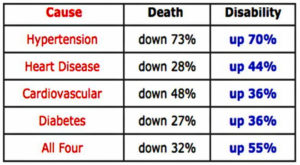

In the last 20 years, deaths due to the “big three” (Cancer, Heart Attack and Stroke) have gone down significantly.

But, disabilities due to those same three are up dramatically!

THINGS THAT USED TO KILL, NOW CAUSE DISABILITIES…

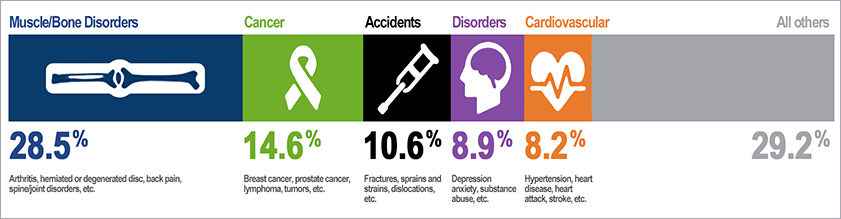

Top five causes of new long-term disabilities in 2012 (Source: Council for Disability Awareness)

As the chart below further illustrates, deaths have decreased while disabilities are up dramatically. For example, the numbers of deaths due to hypertension have decreased by 73%, yet disabilities due to hypertension have increased by 70%.

Statistical information derived from various sources: The Society of Actuaries, The National Safety Council, The Million Dollar Round Table, The National Underwriter, May 2002, The JHA Disability Fact Book 2003/2004 Edition Need For Disability Insurance

BY TAKING STEPS NOW TO PROTECT YOUR ABILITY TO EARN AN INCOME WITH IIP (INCOME INSURANCE PROTECTION),

YOU’RE ALSO PROTECTING YOUR FUTURE WITH PEACE-OF-MIND AND FINANCIAL SECURITY.