✓ Do you know what your future income earnings are worth to you?

More insights at “How much will you earn? You’re worth more than you think!”

✓ Have you ever given thought to just how important your income is to you, your family, your lifestyle, your future?

✓ Everything your income allows you to acquire and own can be replaced with insurance.

✓ Lose your earning power and how do you replace it?

✓ What do you think the consequences would be if you lost your earning power?

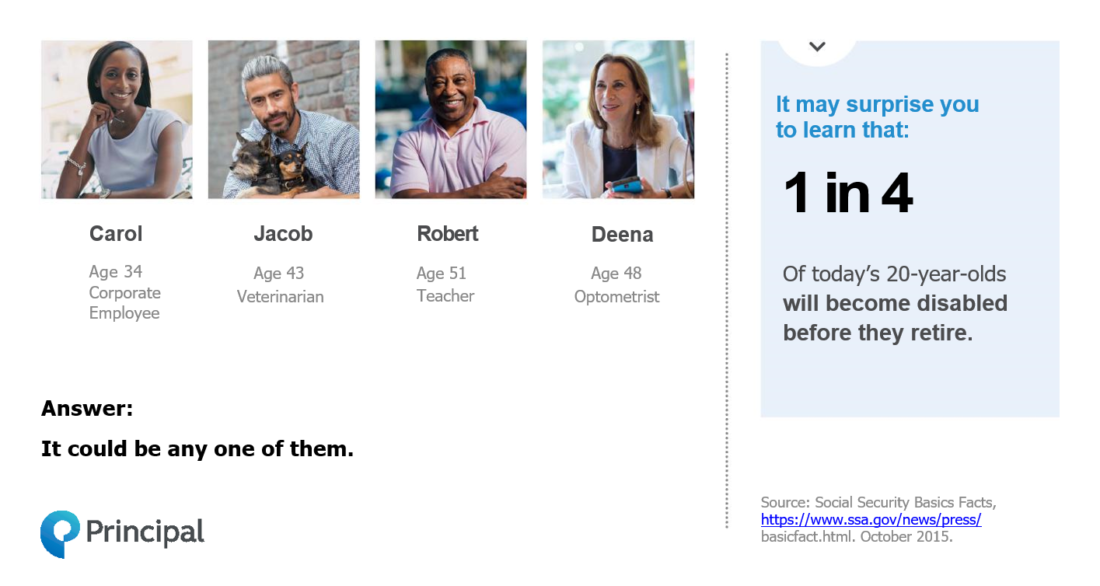

Quick Question — Who below lost their income because of a disability?

IMPORTANT VIP QUESTIONS TO ASK YOURSELF!

VIP – Very Important Planning or Very Important Protection!

BOTH ANSWERS ARE RIGHT!

Who’s prepared for the financial, emotional and lifestyle impact of a disability? NO ONE!

Who wants to think they’re at risk of suffering a disability or certainly not being able to work and earn an income due to a disability? NOBODY!

The difference from my point-of-view. I believe it happens. I have seen it happen. I know it happens, and I have seen income protection benefit my clients who believed it could happen and who listened to my advice.

Most people are not prepared for the financial, emotional, and lifestyle impact of a disability.

The effects of a disability are a horrible tragedy no one should ever face.

What can you do, if you can qualify? Create a money source called (IIP) Income Insurance Protection!

MONEY MAKES THE DIFFERENCE!

Your creditors may feel sorry for your illness or injury.

Do you think the bills will stop because of a disability?

It would be nice if they sent you a get well card, but they

will be sending you another bill for what you owe them.

♦ The Mortgage / Rent will still be due.

♦ Car / Lease payment will still be due.

♦ Food and Grocery costs will continue.

♦ Utility bills will continue.

♦ Insurance premiums will still be due for health, life, and other types of insurance.

♦ Credit card bills will continue to arrive.

♦ Doctor bills for uncovered or out-of-network medical expenses, deductibles, and co-insurance costs will continue.

♦ Cell phone bills will continue.

♦ Cable bills will continue.

♦ What other monthly financial obligations will continue on for you?

♦ Monthly Total $ _______________

Take a few minutes to figure out what are your monthly expenses and where will the money come from to pay these ongoing bills, and living expenses? Do you consider food, clothing, and shelter to be luxuries?

This is why (IIP) income insurance protection is an absolute necessity!

For more info, see “What Are Your Personal Expenses? How Much IIP Do You Need?”

What happens if your paycheck stops due to a disability?

WHAT’S YOUR PLAN B?

How strong is the financial foundation

underneath your monument of money?

What alternative solutions are available to replace

your income and earning power during a disability?

♦

Savings – How long will that last?

♦

Borrow – Who’s going to lend money to someone disabled? How are you going to pay back any loans when you can’t work? Would you loan someone money if they didn’t have the ability to pay you back?

♦

Relatives & Friends – How long will that last? Plus they have their own financial expenses and responsibilities.

♦

Investments & Retirement Plans – A good income protection plan protects these from having to be liquidated. Plus taxes might be required upon liquidation.

♦

Business receivables if you own a company? Without you, profits vanish.

♦

Refinance your mortgage or sell your home. Increase your mortgage payment or sell your home when you need it to the most.

♦

Social Security – Qualifying is tough and monthly benefits are very limited in relation to your current earned income.

All these possibilities have major drawbacks!

NOW CONSIDER HOW RELIEVED YOU’D FEEL IF YOU KNEW YOU HAD MONEY TO…

♦ pay you income to cover personal monthly expenses for many years if partially or totally disabled.

♦ pay your business overhead expense payments, if you own a business or professional service.

♦ continue making retirement contributions for you.

♦ pay off student loans.

♦ pay off business loans.

♦ make payments for caregiver services.

♦ buy you out of your business, satisfying you, a partner or shareholder.

All of these financial issues and worries can be eliminated with (IIP) income insurance protection. You would be SHIFTING THE RISK to an insurance company with a fixed, affordable premium to offset the unknown financial consequences of a disability. Certainly a more practical an economical solution!

Do you know someone whose world changed in a split second because of a disability?

Have you ever known anyone who has been disabled for a period of time? Were you aware of any financial problems they faced or incurred? Did they have income insurance protection?

Do you know how many people were diagnosed in doctor’s offices throughout America today with a medical condition or a dreaded illness? Lots! Sadly, their insurability has been compromised. Should any of these people call me tomorrow with the idea maybe I should consider income protection now? What am I supposed to tell them?

(1) You’re likely to receive a policy exclusion.

(2) You’re likely to pay an additional premium.

(3) You’re likely to receive a modified benefit offer.

(4) You’re likely to be declined.

All of the above is a reality! The time to plan for tomorrow is today before you receive a medical diagnosis of any kind. Sadly people become uninsurable every day. Remember, tomorrow’s outcomes are determined by decisions made today!

The disability insurance industry promotes May as disability awareness month.

I disagree, EVERY day should be Disability Awareness!