Perceptions and Misconceptions

There are Plenty Of Myths, Perceptions, and Misconceptions

About Long-Term Care that Creates a False Sense of Future Security

Unless you have recently experienced long-term care first-hand with a loved one or friend, you may not be unaware of its cost. Or you may not have considered what it is likely to cost in the future when the potential need for care increases. The numbers are eye-opening.

Myth # 1

“It won’t happen to me.”

“I probably won’t need long-term care.”

THE REALITY: 1 in every 2 individuals turning age 65 today will need long-term care support and services. (Department of Health & Human Services, “Long-Term Services and Support for Older Americans: Risks and Financing,” revised February 2016)

70% of people over the age of 65 will need long-term care services at some point in their lives. (U.S. Department of Health and Human Services, National Clearinghouse for Long-Term Care Information, February 2017)

1 out of every 3 individuals over age 85 suffer from Alzheimer’s. (Alzheimer’s Association, “2016 Alzheimer’s Disease Facts and Figures,“ Alzheimer’s & Dementia, 2016)

Myth # 2

“My Health Insurance, Medicare or Medicaid have me covered.”

“I already have health insurance. I must be covered.”

“I’m pretty sure Medicare will take care of most of it.”

“The government has programs that we can depend on.”

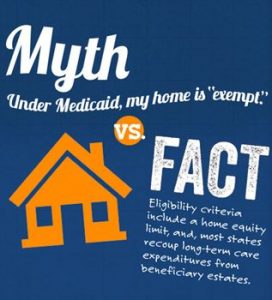

THE REALITY: Health insurance doesn’t pay for long-term care services. Medicare and Medicaid are government-sponsored programs designed to cover health care costs, but they vary greatly. Often individuals mistakenly think these public programs will cover their long-term care expenses.

Medicare primarily provides health insurance for individuals aged 65 and older or for those with certain disabilities under age 65. It is limited and focused on acute care paying for skilled and rehabilitative services if certain conditions are met and for a limited period of time up to 100 days. There is no benefit after 100 days. Medicare does not pay for personal or ongoing non-skilled custodial care, such as helping with bathing or getting dressed (activities of daily living), which typically makes up the majority of long-term care services. Medicare is simply not a resource for long-term care needs.

Medicaid is a government program with strict eligibility requirements. It is designed as a safety net that can help people pay for nursing home and some custodial care services with extremely limited assets and income. Not all nursing homes accept Medicaid, which can limit important choices for individuals. To become eligible to receive benefits under Medicaid, you would need to spend down assets, including real estate and all sources of annual income, so that you’re left with so little that it demonstrates your need for government support. This is why private coverage has become the backbone for protecting assets from the high costs of long-term care expenses.

In addition, these programs have come under increasing funding pressure. A benefit that exists today might not even be there in 15 or 20 years.

Myth # 3

SELF-INSURE — If I need long-term care, “I can self-insure”

or “I’ll pay for it from my investments or retirement plans.”

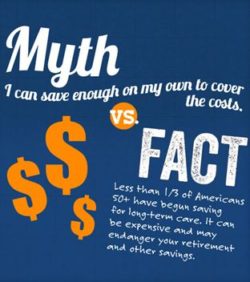

THE REALITY: A long-term care event has a high probability of occurring, and regardless of where you live in the country, long-term care costs are staggering and will likely continue to rise. Plus, the cycle of care is not linear, and it could quickly become overwhelming. Care might start with an in-home health aid and escalate to an assisted living facility or even a nursing home. You may only need care for a few months, a few years or for many years. Accurately predicting how long and how much it will cost you is difficult and a guess at best. Learn more in “Helping You Understand The Cost of Care For Long-Term Care Services Now & In Your Future”.

Some people who want to maintain control of their assets might consider self-funding or paying out-of-pocket for their long-term care expenses. In addition to the risk posed by the high potential costs, self-insuring also involves investment risks for the assets that will potentially be used to pay for care, as well as managing those assets during a long-term care event.

Plus the liquidation of retirement plans or other assets to pay for care can begin a cycle of increased taxation as well as exposure to market volatility during a down period. Will you be able to emotionally handle or deal with the rollercoaster ride when the stock market heads south during the next prolonged dip? Many facing an unplanned care event may spend their investments, retirement plans or savings 2 to 3 times faster than anticipated. The loss of principal also means reduced income impacting the lifestyle of the surviving spouse.

Unless you have several million lying around and set aside for each spouse’s long-term care needs. You may want to question the self-insuring strategy. Paying for unexpected long-term care expenses can put a significant portion of your retirement income at risk and force you to re-allocate assets intended for other purposes. Successfully self-insuring isn’t feasible for the vast majority and even the wealthy can benefit from leveraged opportunities using someone else’s money to pay future long-term care costs.

Budget a premium or reposition an asset. It’s easier with more advantages!

Myth # 4

My family will take care of me when the time comes!

THE REALITY: Women caring for ill parents are twice as likely as non-caregivers to experience depression or anxiety. And the overall cost to a female caregiver is estimated at almost $325,000 because of lost wages and diminished working hours. (Family Caregiver Alliance, “Women and Caregiving: Facts and Figures,” FCA, revised February 2015)

Family may assume the responsibility for long-term care management or expenses, but this can bring emotional and financial stress along the way. More insights in “Future Home Care & Informal Care Giving Problems – An Aging Changing Crisis! Whose Life Is Going To Be Disrupted”.

Myth # 5

“I’ll never end up in a nursing home.”

THE REALITY: Hopefully not, but you still need to plan for other possible eventualities. Even home care is costly, and aging in your home could require expensive modifications like downstairs bed and bath additions, outside ramps, and so on.

Myth # 6

“I’m too young to think about long-term care that’s for older people.”

THE REALITY: Old age, like life, is something that happens when you’re looking away. Positivity is a virtue, but so is preparation. A frequent misperception is that long-term care insurance is only for the elderly or frail. In reality, 40% of people receiving care today are between the ages of 18 and 64. (National Clearinghouse for Long-Term Care Information – Own Your Future – “What Are My Risks of Needing Long-Term Care?” October 22, 2008)

Genworth Financial Beyond Dollars Report July 2015 indicated the age of care recipients is younger than in 2010 when they last did this study. 81% of care recipients were over age 65 in 2010, and 60% of care recipients were over the age of 65 in 2015.

“I’m in great health why worry about this now?” Because no one can guarantee what will happen tomorrow. Today you are healthy, but 24-hours from now things can change.

Many injuries and illnesses require long-term care services, such as automobile and recreational accidents (skiing, horseback riding etc.) or chronic illnesses such as multiple sclerosis, stroke, heart attack or Parkinson’s. Christopher Reeves and Michael J. Fox are both tragic examples of younger aged people who required long-term care before age 65. What about the news reports you frequently hear about accidents causing paralysis at younger ages?

Sadly, long-term care doesn’t discriminate and can happen to anyone at any time. Planning ahead is important at any age. Plus it will cost you less and you increase your chances of qualifying for coverage.

Myth # 7

Long-term care insurance premiums are a burden.

THE REALITY: This statement is highly ironic given the extreme burden that many Americans face once they need care but didn’t plan or don’t have the income to pay the high costs. Who will pay or whose life will be disrupted to provide care? Many Americans receiving long-term care are getting their care from unpaid family members and loved ones. If that isn’t a burden, what is?