“Explaining Income Insurance Protection Underwriting in a Transparently Different Way”

YOU CAN ALWAYS PURCHASE AN INVESTMENT. HOWEVER, YOU CAN’T ALWAYS BUY A GOOD (IIP) INCOME INSURANCE PROTECTION POLICY. WHY?

Your INSURABILITY, which allows you to qualify for good disability insurance, can also change at a moment’s notice. HEALTH IS WEALTH! One may not realize the importance of insurability until it changes or has changed. This is why proper income insurance planning ALWAYS has to occur in advance of an unfortunate medical diagnosis or the actual need for income protection due to a disability.

I can’t tell you the right time to apply. However, I can tell you the wrong time, and the wrong time won’t be the right time. THEREFORE THE RIGHT TIME IS ALWAYS RIGHT NOW!

More insights in “WE’RE IN THIS TOGETHER” and “UNDERSTANDING UNDERWRITING”.

Protecting your ability to earn an income with a good individual disability insurance policy is a significant acceptance of risk by an insurance company. The evaluation process is very comprehensive and involves many factors including your occupation and duties, age, gender, avocation/lifestyle activities, driving record, other disability coverage, and medical/financial information to provide an accurate picture to the underwriter before they will accept you for this valuable financial protection.

Telling you what an individual income insurance protection policy will cost is important, however, it is more important to HELP you understand the following:

(1) What is INVOLVED in the underwriting of an individual disability insurance application?

and

(2) TELLING YOU IN ADVANCE of any possible exclusions, a modified policy or restricted benefits, an extra premium charge, or a declination, and WHY these actions are taken by an underwriter reviewing an application?

The goal here is to always MANAGE YOUR EXPECTATIONS and where my experience counts.

You will never hear me tell you underwriting is simple or easy. However, I will always tell you that it is worth your time and effort to follow me and let me take you through the entire process, and after all the steps have been completed. You will have acquired a valuable income protection policy. One of the most important financial contracts you can own throughout your professional career and working life.

My goal is to HELP bring IIP Income Insurance Protection to MORE individuals, professionals, executives and business owners who understand and recognize the need, get the underwriting process and who will follow me.

EXCLUSIONS, POLICY BENEFIT MODIFICATIONS, OR EXTRA PREMIUM CHARGES

The underwriter is the person on behalf of the insurance company who carefully reviews the information provided them regarding your insurance application to determine risk factors, if any, using guidelines and procedures established by the insurance company. Disability underwriting is strict because the underwriter has only one chance to evaluate the potential risk and make a decision. In addition, disability claims can cost an insurance company a great deal of money if the underwriter makes a mistake.

I would hope every application is APPROVED AS APPLIED FOR with no changes and all the benefits approved by an underwriter. This isn’t always the case. In many situations, an underwriter will review an application, and make an OFFER OTHER THAN AS APPLIED FOR with a policy exclusion(s), benefit modifications or even require an extra premium charge due to the perceived risk the insurance company faces regarding potential future claims.

Your entire body is being evaluated when you apply for an individual disability insurance policy. HERE ARE SOME SIMPLE FACTS! Exclusions, policy benefit modifications, or even extra premium charges are common in an offer you might receive for an individual disability insurance policy.

Here are the reasons why medical exclusions are necessary when the underwriter has identified medical history…

♦ that increases the chance of you making a disability claim at some point in the future.

♦ that you have a specific medical problem with clearly identifiable symptoms, such as organ, joint or musculoskeletal disorders.

♦ that an impairment is severe, recent, very specific or likely to recur.

♦ that the risk can be clearly defined and easily excluded.

NOTE: Paying a higher premium doesn’t work due to the nature of disability insurance. Let’s say the insurance company increased the premium for this person by 100% but gave full coverage for an excluded back problem. That person could pay a few months of premiums then immediately turn around and go out on a claim for a back problem.

Since premiums are waived when someone is on a claim, this person would be entitled to full benefits after the waiting period for the entire benefit period. Without this kind of medical exclusion, the medical risk would be too great for the insurance carrier to assume, and the insurance company would not be able to offer that person the income insurance protection they need for all other disabling conditions.

In assessing your situation, the underwriter takes into account not only your present state of health, which may be fine but also the risk of future problems. It is important to note that a medical exclusion rider doesn’t change the premium of the policy.

You’re probably not aware of common medical conditions you may be treated for such as chiropractic care for back related issues, mental health therapy / medications for depression, anxiety or attention deficit disorder and why these medical issues result in policy exclusions or benefit modifications.

Consider, even though your chiropractor makes your back feel good, there is an underlying back-related problem, which would be of concern to an underwriter regarding the frequency of back-related disabilities.

Or you may be in good mental health, but stress causes many disabilities, and this would be of concern to an underwriter who would consider this in an offer to someone in therapy.

Are you a thrill seeker? Extreme sports will also increase the risk factor an underwriter would be concerned about in reviewing your application.

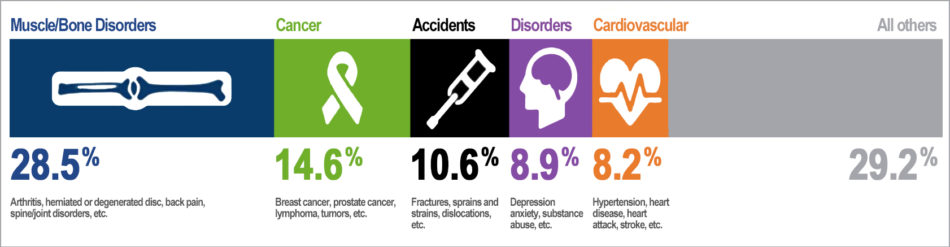

(Source: Top five causes of new disability claims in 2012; Council for Disability Awareness)

RECEIVING AN OFFER OTHER THAN AS APPLIED FOR AND THE VALUE OF THESE MODIFIED OFFERS

Modified offers are not bad offers as the underwriter might provide us with multiple options to consider, e.g. policy exclusion(s), charging an extra premium, extending the waiting period for the entire policy or for a specific condition. Maybe all benefits applied for will not be offered or maybe the benefit period will be reduced from age 65 to 5 years. It’s all dependent on the risk factors the underwriter is considering when evaluating your application.

Know the company wants to approve disability insurance applications and collect premiums, but this is how they balance out the risk to the insurance company.

It is very important to keep OFFERS OTHER THAN AS APPLIED FOR in perspective, as there are a thousand illnesses in a medical dictionary or even numerous injuries that can disable you and are still covered under the policy.

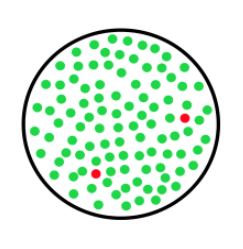

Consider, there are 100 dots in this circle. 98 are green and 2 are red. The 2 red dots represent exclusions and the other 98 represent conditions you are covered for under the policy.

KEEP IN MIND THAT SOME EXCLUSIONS ARE TEMPORARY. THE GOOD NEWS IS, DEPENDING ON THE EXCLUSION, IT CAN BE RECONSIDERED FOR REMOVAL, ASSUMING YOU ARE SIGN, SYMPTOM, AND TREATMENT FREE FOR A PERIOD OF TIME. THIS CAN BE 1 TO 3 YEARS DEPENDING ON THE COMPANY AND SEVERITY OF THE MEDICAL CONDITION.

For example, an exclusion due to a recent knee surgery could be reviewed and removed after a specified period of time, if there are no complications from the surgery and you have fully recovered.

HOW DOES AN EXCLUSION ON A POLICY AFFECT A CLAIM?

An exclusion rider generally states that benefits are not payable for disability resulting from or related to a specified medical condition (e.g., asthma), from a disease or disorder of an area or part of the body (e.g., the cervical spine), or injury sustained while participating in a specific activity (e.g., rock climbing). The intent of the rider is to exclude or restrict coverage for claims resulting from or related to a preexisting medical condition, or claims resulting from participation in a potentially hazardous activity that presents an increased RISK of potential disability to the company.

Regardless of an exclusion rider on a policy, if a disability should arise you should submit a claim form to determine if the exclusion applies and let the claims department evaluate the facts and circumstances of your claim to determine your eligibility for benefits assuming all of the other terms and conditions of the policy are met.

A HYPOTHETICAL CLAIM EXAMPLE WITH A POLICY EXCLUSION

For example, if a back disorder for your cervical spine is excluded, the exclusion might state there would be coverage for a laceration, fractures or burns as well as anything unrelated to the back disorder.

If your cervical spine was excluded from coverage due to a history of a herniated disc, disabilities caused by or related to the herniated disc or other associated conditions (e.g., sprains, strains, degenerative disc disease, arthritis, etc.) would not be covered. However, in the event the disabling condition was caused by an unrelated traumatic event such as an automobile accident and the claims department determines the preexisting condition did not contribute to the disability, the exclusion rider would not apply. In this event, you could have a covered claim and benefits would be paid, even though that traumatic event resulted in an injury to your back. A cervical spine exclusion might also pay benefits for a laceration, fracture or burns.

Further, if you suffer from two simultaneous disabling conditions where one is specifically excluded from coverage under an exclusion rider and one is not, then you may have a valid claim if the covered condition renders you disabled and if all of the other terms and conditions of the policy are met.

DISCLAIMER: This is a hypothetical claim example and meant only to explain how an exclusion rider or a modified policy might be applied in the event of a claim for disability benefits. Disability claims can result from countless causes. A claim for a disability is evaluated on its own set of circumstances, and paid according to the wording of the specific exclusion as well as the terms and contractual provisions of the policy.

WHAT TO DO IF YOUR APPLICATION IS DECLINED

FOR SOMETHING WE COULDN’T ANTICIPATE?

Ideally, there should be no surprises in the processing of your application. Here are two reasons why an application can be declined. Sometimes medical records aren’t reviewed in advance when something is noted, which you weren’t aware of, and the underwriter now has adverse knowledge upon seeing your doctor’s records, or an abnormal result shows up after providing blood or urine tests if required, and the underwriter declines your application.

Appeal the Decision: The insurance company will send you the specific reason for your declination. We will discuss your situation. I have been successful over the years reversing decisions when correcting erroneous information, providing a clarification letter from the doctor or some additional medical testing. However, there are times when the risk factors are so great there is nothing that can be done to reverse this decision.

Substandard Options: There are some options to place your disability insurance with a few substandard insurance companies at a higher premium with limited or restricted benefits.

Group Long-Term Disability: You may own a company and provide this as an employee benefit, which ultimately benefits you, or your employment situation changes and your new employer offers group long-term disability benefits, which you sign up for this coverage. Group LTD is easier to get because underwriting standards are less stringent or simply guaranteed issue. Of course, group disability insurance will offer you less coverage than an individual plan, but some coverage is always better than no coverage.

Other Options: Maybe you can purchase some other form of group coverage through an organization, labor union, or trade association to which you belong. Some coverage as stated above is always better than no coverage. You just have to look at the details and limitations closely.

My goal, based on the information provided to me is always telling you in advance, before applying, what issues you’ll face in underwriting while we work together to get you the best offer and coverage possible.